tax benefit rule quizlet

Under the so-called tax benefit rule a taxpayer need not include in his gross income and therefore need not pay tax on it amounts recovered for his loss if he did not receive a tax benefit for the loss in a prior year. Of course if you were not able to itemize for 2012 none of your state tax refund is taxable for 2013.

Ch 6 Tax Benefit Rule Flashcards Quizlet

Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2020.

. The tax benefit rule requires Company XYZ to report the 100000 as income on its 2010 tax return and pay taxes on it. Why Does a Tax Benefit Matter. If an amount is zero enter 0.

Benefits received or reciprocity theory The state collects taxes from the subjects of taxation while the citizens pay. 4822 726 PM 01 Principles of Taxation Flashcards Quizlet 322 necessity or lifeblood theory Theory Where. Tax Shield Formula Sum of Tax-Deductible Expenses Tax rate.

Interest deduction on home mortgage. If The existence of the government is a necessity then Power of taxation is essential in order to perform the basic functions of the government. If an amount deducted as an itemized deduction in one year is refunded in a subsequent year it must be included in gross income in the year in which it is refunded to the extent to which a tax benefit was obtained in deducting this amount.

De minimis benefit whether given to rank and file employee or to supervisory or managerial employee is not subject to fringe benefit tax D. The two most important tax forms for trusts are the 1041 and the K-1. Payroll taxes used to finance social security may also reflect a link between benefits and contributions but this link is commonly weak because contributions do not go into accounts held.

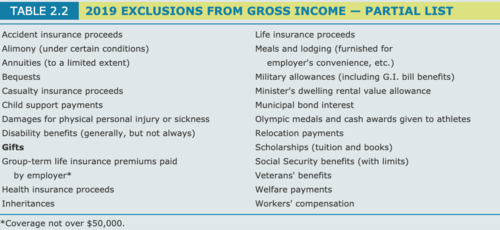

Gross income does not include income attributable to the. One common source that is frequently overlooked by tax advisors and more often misunderstood is the application of the tax benefit rule IRC section 111 to state and local tax refunds. The benefits are subject to income tax withholding and employment taxes.

Examples of tax benefit. Form 1041 is similar to Form 1040. Ordinary loss allowed on Section 1244 stock.

Although tax shield can be claimed for a charitable contribution medical expenditure etc it is primarily used for interest expense and depreciation expense in the case of a company. How the deduction works. The benefit principle is utilized most successfully in the financing of roads and highways through levies on motor fuels and road-user fees tolls.

In 2014 Sammy inherited some money. Fringe benefits include cars and flights on aircraft that the employer provides free or discounted commercial flights vacations discounts on property or services memberships in country clubs or other social clubs and tickets to entertainment or sporting events. But the benefit to the employee isnt completely free under current tax law.

Oranges cost of the furniture was 600. On this form the. So the tax benefit you received from the 300 refund was only 225.

Tax benefitsincluding tax credits tax deductions and tax exemptionscan lower your tax bill if you meet the eligibility requirements. Tax-free profits on your home sale. A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a subsequent yearthe money must be counted as income in the subsequent year.

The tax benefit rule is codified in 26 USC. Note however that the tax benefit rule does not prevent companies. This process is often complicated by the complexity of the related tax rules for personal use of a company vehicle.

Tax Forms. Fringe benefit given to rank and file employees is not subject to fringe benefits tax B. Their AGI was 104825 and itemized deductions were 27800 which included 22240 in state income tax and no other state or local taxes.

An excess benefit transaction is a transaction in which an economic benefit is provided by an applicable tax-exempt organization directly or indirectly to or for the use of a disqualified person and the value of the economic benefit provided by the organization exceeds the value of the consideration received by the organization. Essentially personal use of a company car is treated as a taxable fringe benefit subject to income tax withholding obligations by the employer. In 2013 Orange took a bad debt deduction for the 1000 because Sammy would not pay his bill.

Equivalently stated taxpayers must include in income any amounts recovered if they. A taxpayer itemized in 2011 and deducted state income taxes paid in 2011. The tax benefit rule means that if a taxpayer receives a tax benefit from an item in a prior year because of a deduction and then recovers the money in a subsequent year the money must be treated as taxable income.

In 2012 the Orange Furniture Store an accrual method taxpayer sold furniture on credit for 1000 to Sammy. Basic rules on fringe benefits tax except A. Suffers a fire a few days after completion of a building that cost 500000 to build.

Fringe benefit given to a supervisory or managerial employee is subject to fringe benefits tax C. The tax benefit rule is intended to ensure that companies do not write off debt with the intention of collecting it later and not paying taxes on it. Published by David Klasing at March 21 2014.

Often applies to refunds of itemized deductions like state income tax and medical expense deductions. Which provision could best be justified as encouraging small business. How does the tax benefit rule apply in the following cases.

Simply stated the refunds recoveries are taxable only to the extent the taxpayer received a tax benefit from the deductionthat is the deduction must have reduced taxes or. If youre a homeowner who now pays 7000 in state income taxes but your property taxes are 6000 youll only be able to deduct 3000 of your total property tax bill. The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year income tax consequences of the later event depend in some degree on the prior related tax treatment.

To determine if an excess benefit transaction. Myrna and Geoffrey filed a joint tax return in 2019. Domestic production activities deduction.

One of the tax benefits of owning a home doesnt kick in until after you sell your home tax-free profits.

Acnt 1331 Chapter 2 Flashcards Quizlet

R5 M5 Multi Jurisdictional Tax Issues Flashcards Quizlet

R1 M3 Gross Income Part 2 Flashcards Quizlet

R2 M4 Amt And Other Taxes Flashcards Quizlet

Tax 4001 Chapter 3 Flashcards Quizlet

Accy 405 Tax Chapter 5 8 Flashcards Practice Test Quizlet

R2 M3 Tax Computation And Credits Flashcards Quizlet

R2 M2 Itemized Deductions Flashcards Practice Test Quizlet

Acct 3315 Final Uta Repsis Flashcards Quizlet

R2 M4 Amt And Other Taxes Flashcards Quizlet

Accy 405 Tax Chapter 5 8 Flashcards Practice Test Quizlet

Federal Income Tax Flashcards Practice Test Quizlet

R2 M2 Itemized Deductions Flashcards Practice Test Quizlet